BOOST YOUR SHOPPING BASKET SALES WITH ASSIGNED CREDIT

Expand your online sales and speed up your customers’ purchasing decisions, even for large baskets, by offering them a credit solution of up to €30,000. Opt for simple, intuitive and customizable pathways designed to integrate easily with your e-commerce site.

An innovative financing solution for purchases up to €30,000 !

- For your customers

Amazing ! Financing of baskets up to €30.000

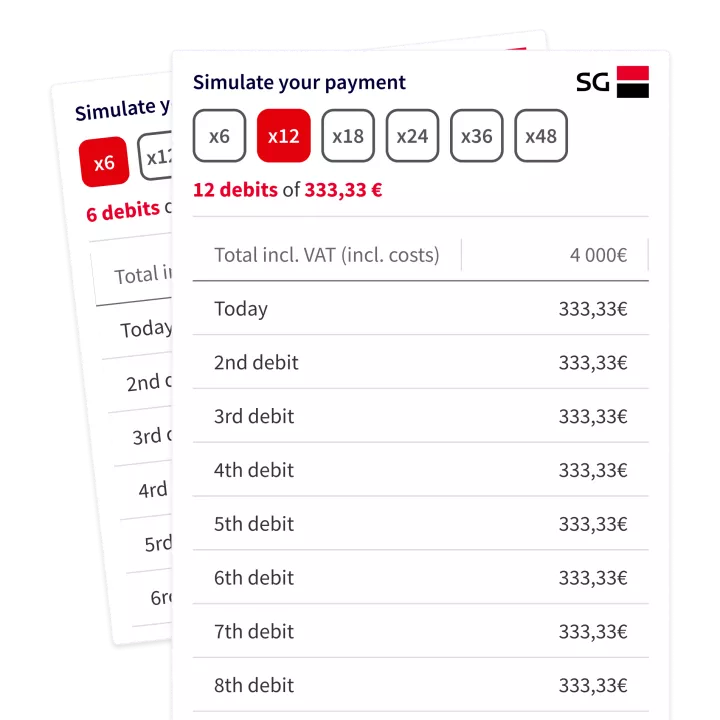

Offer your customer the most appropriate financing solution for either large purchases or longer durations. The amount and duration of the loan are transparent, adapted to your customer's basket and repayment capacity.

- For you

+ 50% increase in average basket (1)

You benefit from a financing solution covering all of your site's product catalogue, facilitating your customers' purchasing decisions and increasing average basket size.

- For your customers

Simplicity of subscription, instant response

Offer your customers a quick and simple financing package, with less bureaucracy and an immediate response in the event of acceptance for baskets under €3,000.

- For you

Payment guaranteed, full coverage of fraud

Your customers spread their purchase over up to 60 monthly instalments, you receive payment for the order within a few days. We help you improve the quality of your sales with the management of fraud risks and possible non-payments on your transactions.

Credit up to €30,000

| Features | |

|---|---|

| Country | France |

| Basket amount | from €1,000 to €3,000 |

| Duration | 4 to 60 months |

| Payment period | 8 days minimum once the order has been placed |

| Set-up fee | €0 |

| Customer journey | |

|---|---|

Response time

|

|

| Proof | Suitable for financing |

| Means of payment | Debit |

| Electronic signature / Face recognition | Included |

| Cancellation / Refund | Included |

| Garantie / Sécurité | |

|---|---|

| Lender | Franfinance (2) |

| Cover of unpaid amount | Included |

| Payment guarantee | Included |

| Fraud risk management | Included |

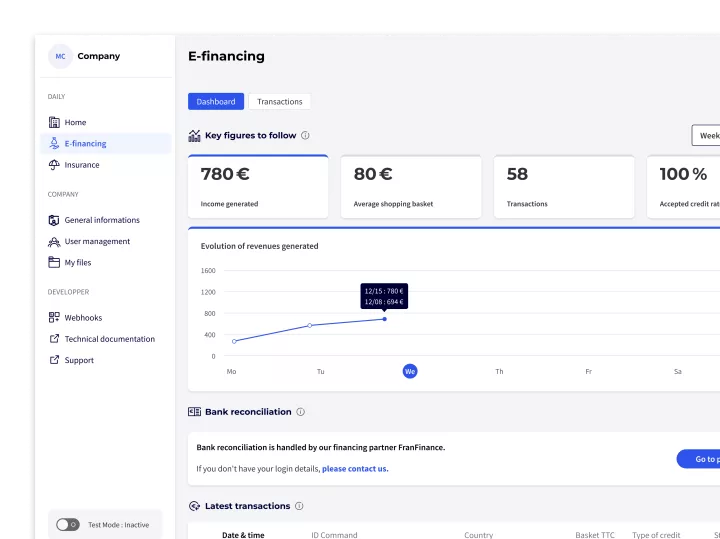

Effective dashboards to manage your sales

- Track your KPIs

and benefit from insights to optimise your sales. - Track your transactions

and manage special cases (refunds, cancellations) - Export your data

and simplify your accounting reconciliation

Tools designed for intuitive, simplified integration

Standard integration via APIs or Plugins

Discover a modular, versioned API set, guaranteeing integration via Rest API.

You can also take advantage of Prestashop and Magento compatible plugins to enhance your functionalities

![]()

Technical documentation to get you started

Technical documentation is available to help you get started easily. It includes diagnostic help, sample code, and concrete integration use cases.

![]()

Dedicated support during integration

If you need help, contact our support team of experienced developers via a special channel. We'll support you responsively, from installation through to day-to-day management.

Why is Societe Generale launching an e-commerce platform ?

Societe Generale is launching the Scalexpert platform in order to provide a range of modular financial services to French merchants wishing to expand throughout Europe. The platform currently includes three initial building blocks: consumer loans, instalment payments, and extended warranties. It enables BtoC merchants to integrate and manage their financial solutions more easily, via unified APIs and CMS plug-ins. It will gradually be enhanced with additional services.

Our partner for credit up to €30,000 :

Our other online financing solutions

Ready to start attracting new customers with SCALEXPERT ?

(1) Source : Kantar Europe, 2021

(2) FRANFINANCE, lender (SA with share capital of €31,357,776 - 53 rue du Port, CS 90201, 92724 Nanterre Cedex – Nanterre Trade and Companies Register no. 719 807 406) - Insurance intermediary - ORIAS no. 07 008 346 (www.orias.fr)