OFFER BANK TRANSFER COLLECTION SOLUTIONS THROUGH A STRONG PARTNERSHIP BETWEEN FINTECTURE AND SOCIETE GENERALE

Fintecture reinvents the bank transfer payment experience by simplifying, securing and reconciling your cash receipts

Increase your sales with transfer solutions from our partner Fintecture

- SMART TRANSFER & IMMEDIATE TRANSFER

2 complementary solutions that make it possible, among other things, to circumvent bank card limits

Smart Transfer

- A bank transfer to a dedicated IBAN for each customer, reconciled and traceable in real time. This solution is ideal for BtoB sales.

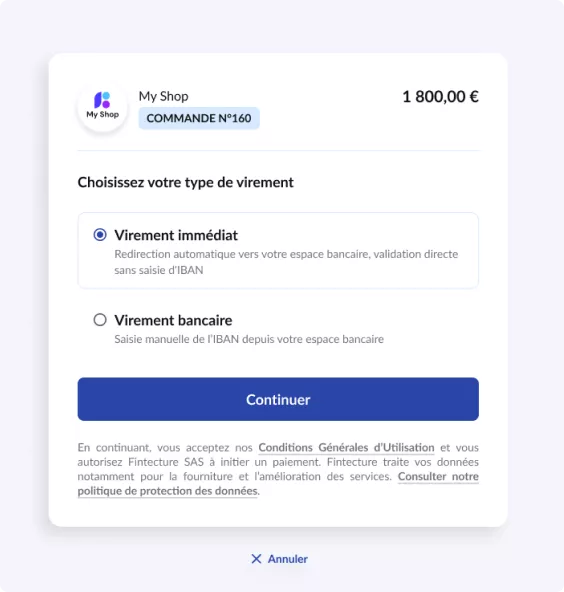

Immediate Transfer

- A transfer by payment initiation (using Open Banking technology), with no IBAN to enter or interruption of the process.

Payment methods adapted to all your sales channels:

E-commerce, mail order, points of sale

Fintecture offers you all the advantages of transfer through its two solutions

IMMEDIATE TRANSFER |  SMART TRANSFER | |||

|---|---|---|---|---|

| High payment limits | Included | Included | ||

| Immediate confirmation of payment to start ordering straight away | Included | If the transfer is made instantaneously | ||

A finance department freed from time-consuming tasks All your payments are identified and reconciled in real time. | Included | Included | ||

A decentralised view of your payments Relieve your accounting teams: all your teams can monitor the execution of transfers in real time | Included | Included | ||

| Protection against IBAN theft | Included | Included | ||

| Features | |

|---|---|

| Country | Your customers worldwide (SEPA and SWIFT) |

| Term | 12-month contract |

| Basket amount | Fintecture solutions are technically unlimited. The limit is linked to that of the transfer, so it depends on the payer's bank. |

| Payment term | Immediate or deferred depending on your use case |

| Payment guarantee | Included |

| Thanks to our trusted partnership, you benefit from the pricing conditions negotiated between Societe Generale and Fintecture | |

- Smart transfer

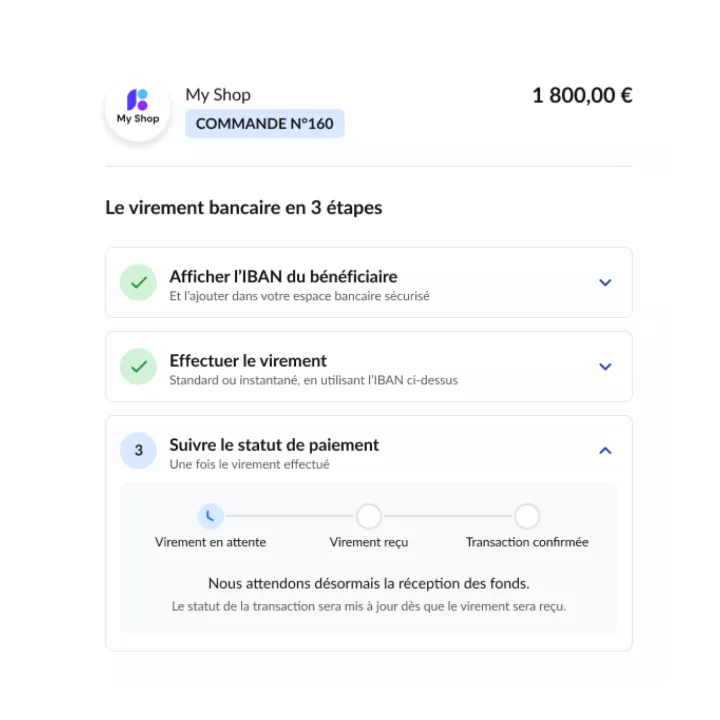

Optimise your payments with Smart Transfer

A bank transfer to a dedicated IBAN for each customer, reconciled and traceable in real time.

- Automated and simplified collection : Automatically reconciled transfers and real-time monitoring of the arrival of funds to validate your orders quickly, without having to call on your accounting departments.

- An identical customer experience : A traditional bank transfer on a real-time IBAN and better payment visibility.

- Immediate transfer

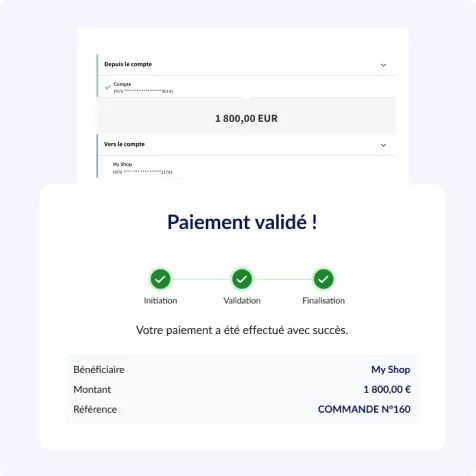

Generate additional sales with Immediate Transfer

A transfer by payment initiation without an IBAN to be entered or interruption of the process.

- Optimised collection : Choose the ideal payment method for high-value baskets: secure, irrevocable and more competitive, covering all your sales channels. You get an immediate payment confirmation, like a bank card payment.

- Simplified transfer: Offer your customers a seamless and secure experience: payment without IBAN entry, high ceilings and integration with over 3,000 banks.

- Sales channels

Payment methods adapted to all your sales channels

- E-commerce site : Improve your online conversion with a seamless payment method that complements your bank card.

- Remotely or at a point of sale : Create payment links without integration, by email, SMS or QR code from your Fintecture space.

FINTECTURE guarantees you more efficient and fully secure payments

![]()

100% automated reconciliation

Fintecture identifies the payer and the invoices attached to it in real time, regardless of the transfer method chosen by the customer.

![]()

Fight against payment fraud

Protect against the risk of IBAN fraud.

Thanks to Fintecture, you will no longer need to provide the details of your main bank account.

![]()

A 100% secure means of payment

Benefit from a solution regulated by the ACPR, adopted by market leaders, and distributed in partnership with Societe Generale

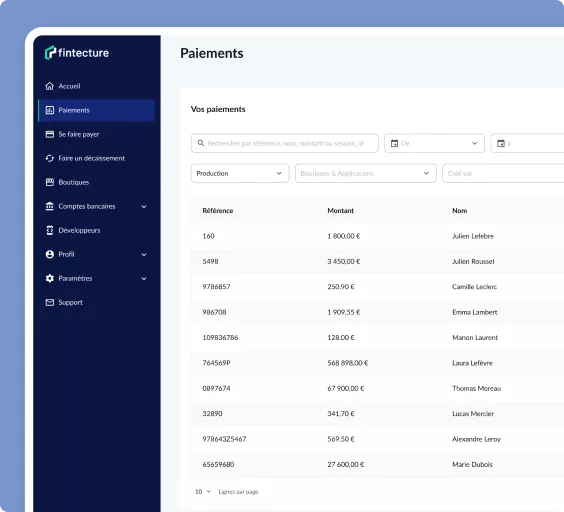

Fintecture's high-performance dashboards to monitor your sales in real time

- Track your KPIs

and benefit from insights to optimise your sales. - Track your transactions

and manage special cases (refunds, cancellations) - Export your data

and simplify your accounting reconciliation

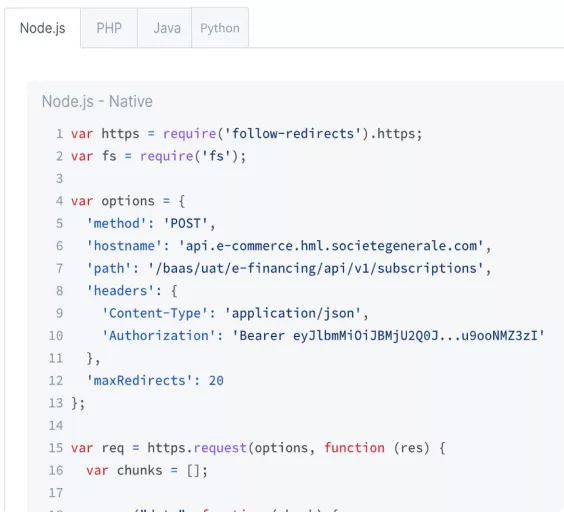

Simplified integration of transfer solutions

Fintecture provides you with 3 integration methods :

- No code

a quick and easy way to offer payment links without the need for integration - Plugins

a rich list of available plugins (Prestashop, Magento, WordPress, Shopify, Oasis) - API/SDK

APIs to initiate and manage your transfers

Societe Generale partners with Fintecture to deliver the best experience in money transfer solutions

- Strong partnership between Fintecture and Societe Generale

Societe Generale has been distributing Fintecture solutions to its customers since 2021 Fintecture, the reference for payment by transfer for commerce

To meet your challenges particularly in BtoC or BtoB, high-value baskets, reconciliation.

Solutions valid in: e-commerce, in-store or remotely by payment link- An approved payment institution

A Fintecture-approved payment institution is regulated by the ACPR (no. 17248), owns its payment infrastructure and operates without an intermediary

FAQs

What is Fintecture ?

Fintecture is a French company specialising in bank transfer payments, offering innovative solutions for in-store and online shops. Supervised by Banque de France and regulated by the ACPR under no. 17248. Having its own payment infrastructure, operating without an intermediary, ensuring efficiency and security

Why is SG offering the Fintecture service?

SG has teamed up with Fintecture to offer its merchant customers high-performance, secure payment solutions. This partnership addresses a wide range of needs, including inter-company payments (BtoB) and high-value transactions, while ensuring easy reconciliation and enhanced transaction security. Fintecture's expertise and innovative technology will enable SG to enhance its service offering and better serve its customers.

How can I subscribe to Fintecture's solution?

First of all, our experts will support you in defining the best solution in line with your needs. We will then put you in contact with our partner Fintecture in order to finalise the subscription and activate the product in production.

How can I integrate Fintecture's solutions?

1. Consult the documentation: Visit our website at Integrate Fintecture payments | scalexpert API Docs (societegenerale.com) to access the detailed integration documentation.

2. Integrate with Fintecture tools: Use the means provided by Fintecture (no code, plugins or APIs) to integrate the payment solutions. Follow the steps and guidelines provided for seamless integration.

3. Test and deploy: After integration, perform tests to ensure everything is working properly before deploying into production.

READY TO LAUNCH TO ATTRACT NEW CUSTOMERS WITH SOCIETE GENERALE X FINTECTURE?

Fintecture | 5 avenue du Général de Gaulle, 94160 Saint-Mandé | SAS au capital de 144 596 € immatriculée au RCS de Créteil sous le numéro 834 500 548